As the European Commision and the IMF conduct their latest post-Keynesian "social and economic experiment" in Latvia to see whether it is possible to revive an economy which is contracting at an annual rate of 18% under the weight of debt deflation relying almost exclusively on a process of drastic fiscal cuts - a process which today is glorified with the name of "internal devaluation" but which in the 1930s was simply called what it is: wage and price deflation - a new problem looms its head. What, we might like to ask ourselves will be the long run consequence for Latvia's already fragile demographic dynamic if we don't get a most-optimistic-scenario-best-case outcome here? That is, if instead of a devaluation-driven "V" shaped recovery, we get not a "U" shaped one (the optimistic scenario), but rather "L" shaped stagnation (a distinct possibility on my view, if wages and prices simply take too long correcting to competitive rates) what will be the implications for the longer term future of the country?

The question I want ask here is simply whether or not short term decision taking on the part of the Latvian government (the crisis "exit strategy") may not produce knock-on effects on the short term decision process of potential Latvian parents leading them to postpone decisions on parenthood, such that the impact of the crisis is a further deterioration in long run population dynamics, and hence, ironically, in potential economic performance? What I am asking is whether or not there may be a kind of "vicious circularity", whereby one negative feedback process influences another in a way which produces a very unfortunate outcome. Not for nothing do we say that social systems are complex ones!

But before we go into the nitty gritty of all this, I would like to just take a quick look at two charts.

Structurally, they look quite similar don't they? They are both output charts, showing year-on-year changes in production. The second is a chart for industrial products, and the first is a chart for children. Strange they should look so similar, isn't it? Or is it? Below I will go into some recent work by economists and demographers which providing a theoretical background within which we may be better able to understand the sort of complex processes we can see operating in Latvia. At the end of the post we will then breifly take a brief look at some of the conclusions it might be possible to draw from what is happening.

Structurally, they look quite similar don't they? They are both output charts, showing year-on-year changes in production. The second is a chart for industrial products, and the first is a chart for children. Strange they should look so similar, isn't it? Or is it? Below I will go into some recent work by economists and demographers which providing a theoretical background within which we may be better able to understand the sort of complex processes we can see operating in Latvia. At the end of the post we will then breifly take a brief look at some of the conclusions it might be possible to draw from what is happening.Theoretical Background

Basically there are two key line of approach which may help get to grips with the present situation, one of these is the Low Fertility Trap hypothesis advanced by the Austrian demographer Wolfgang Lutz. The other is the cohort-size-driven relative-income-hypothesis advanced by US economist Richard Easterlin. You can find a nice summary of Wolfgang Lutz's low fertility trap hypothesis in this earlier post by Claus Vistesen. Essentially Lutz argues that the negative dynamic associated with long term below replacement fertility may produce self reinforcing processes such that the anticipated "rebound" in fertility levels simply does not take place. Needless to say there is considerable (negative) evidence in support of the idea that societies where fertility falls to "lowest-low" levels (defined as below 1.3) have considerable difficulty in reovering sustainable longer term fertility levels (circa 2.1) even if the reasons for such difficulty are still a matter for debate. Essentially there are three components to the Lutz hypothesis, and these can be seen in the diagram below:

As Lutz says the key idea is that once fertility falls below a certain level (and even in the event that the hypothesis proved to be well founded this level could only be determined empirically, on the basis of actual experience) a self-reinforcing demographic regime may be established from which it is hard to escape, in the sense of raising fertility back up towards replacement levels. The cut-off point which Lutz et al start from is 1.5 (and in this they take their lead from a proposal by Peter Macdonald in this paper ). This figure does seem to have some coherence in terms of actual experience to date, since with the exception of Denmark - which did briefly fall under 1.5 tfr in the 1990s - no country seems to have gone below this and come, and stayed, back up again.

Now Lutz identifies three potential self reinforcing processes - population momentum, ideational processes, and economic factors - but in this post I want to focus on one of these, the economic one. The explanatory mechanisms we are offered are full of self-reinforcing feedback processes, as can be seen from the diagram below (incidentally please click over the image for better viewing):

Based on work which Claus Vistesen and I have been doing applying Modgigliani's Life Cycle Model of consumption and savings in the context of rising population median ages I think it is now possible to flesh out just how some of these processes work (see, for example, this post, or my Taking Solow Seriously - Does Neoclassical Steady State Growth Really Exist? post, or Claus here on Japan's engine failure).

Essentially, the argument we are developing is that as median ages rise beyond a certain point - 42/43 let's say - the structural characteristics of an economy change. While younger economies - let's say with median ages in the 35 - 39 range - are driven by large scale borrowing (on aggregate), domestic consumption surges, and, of course imports and current account deficits to match the domestic savings weaknesses. More elderly societies exhibit higher relative savings levels (Japan, Germany and Sweden would be the classic cases), can no longer rely on domestic consumption to anything like the same extent, and increasingly come to depend on export growth and lending abroad to achieve economic growth. This situation is highly unstable, as we are witnessing now in the Swedish case, since as the consumer booms in the younger societies fail, exports slump and many of the loans go bad. This is not a very satisfactory state of affairs, but it is in fact what is happening. This is the demographic transition we are all part of.

Basically, I would argue it is possible to think about four economic mechanisms which "feed" the low fertilility "loop" in the longer run.

1) In order to compete for exports the elderly export-dependent economies have a permanent pressure on their tradeable sectors, whereby outsourcing is continuous and ongoing, wages are continuously compressed, and structural reform is permanent. Since the very export dependence is only further reinforced by the continuing process of change in the population pyramid (ie domestic demand never "recovers" as such) this is all self-reinforcing. That is to say, the more time passes the more there is downward pressure on the wages of young people, and this pressure evidently influences decision taking about parenthood among young people.

Indeed the negative re-inforcing mechanism on domestic consumption can be even stronger, as can be seen from this chart for German retail sales. These, it will be noted, have been falling since the start of 2007, despite the fact that 2007 was a "bumper" year for the German economy. This has nothing to do, please note, with any supposed impact of the global economic crisis, since it evidently pre-dates this. And what happened in January 2007 which set this decline in motion? Guess what, a three percent hike in VAT consumption tax. The hike was, ironically, introduced in order to help pay ageing society health costs. So just like the theory predicts, the consumption of young people is squeezed to help pay the cost of high elderly dependency ratios, and it is squeezed with important structural consequences for the economy. There has been a great deal of noise and hot air spoken of late about who did, and who did not, see this crisis coming, but I would direct your attention to this post by Claus Vistesen on A Fistful of Euros in February 2007 - a (then) 22 year old business school student in economics at the Copenhagen Business School giving Master Classes in economics.

So watch out Latvia, since you just hiked your VAT consumption tax!

2) Due to the comparatively lacklustre economic growth performance there is a constant shortfall in the tax income necessary to guarantee existing welfare and pension commitments. This shortfall is produced by the low levels of trend growth (think Italy, Germany and Japan) which you can generate exclusively on the basis of export growth. Since the changing pyramid structure (here is another part of the feedback loop) means that an increasing part of the voting population comes to be over 50, the tendency, as we are in fact seeing, is to attempt to maintain welfare commitments by increasing the tax burden, which affects the consumption and earning possibilities of the young directly.

3) Migration factors. As societies age, the general lack of economy growth, and the tendency towards increased retirement ages and higher participation rates at the older ages, all mean that there is a relative lack of well paying jobs at the entry level, a phenomenon which makes outward migration an increasingly attractive proposition for educated young people (again, as we are seeing in Germany and in Italy). This out-migration once more feeds back into the structural evolution of the population pyramid. If the out migration is in part compensated for by in-migration of lower skilled workers, then this tends to retard the process of moving towards higher value work, a feedback which one more time would seem to find reflection in lower wage levels on average in the younger age groups.

4) Impediments on pro-natal policies. The pressure on fiscal resources which result from the previous three factors mean that effectively it becomes increasingly difficult to generate the resources to finance really meaningful pro-natal policies which might attempt to "tease" fertility back up towards a higher level. As time goes by this problem only gets worse.

Easterlin and Macunovich

Lutz, for his part, bases his economic feedback mechanism on the cohort impact theory of Richard Easterlin and on the relative income hypothesis he uses as the transmission mechanism for this. According to Easterlin changing cohort size produces either a crowding-out (the baby boom) or a crowding-in (declining fertility) phenomenon. The hypothesis posits that, other things being constant, the economic and social fortunes of a cohort (those born in a given year) tend to vary inversely with the relative size of that cohort, which is itself approximated by the crude birth rate in the period surrounding the cohort's birth. The cohort mechanisms operate mainly through three large social institutions – the family, the school and the labour market. Diane Macunovich has a good summary of Easterlin's ideas and their application to fertility changes in Relative Cohort Size, Source of A Unifying Theory of the Global Fertility Transition (Macunovich, 2000, online here).

The operation of this general 'crowding mechanism' means that large birth cohorts face adverse economic and social conditions, higher unemployment, and lower than expected wages, outcomes which are significantly at odds with their material aspirations. As a result, they postpone family formation and have fewer children. This line of research now represents a long-standing tradition in the United States, where an ongoing body of work (Easterlin 1975, 1978, 1980, 1987, Macunovich 1998a, 1998b, 2000, 2002, Bloom, Freeman, and Korenman, 1987, Korenman and Neumark, 2000) has posited the idea that the relative size of young cohorts entering the labour market has far-reaching implications for wages, inflation, unemployment rates, etc, as well as for a variety of cohort impacting factors like living standards and family behaviour. The core idea behind the crowding thesis is also now being applied in studies of the 'greying' phenomenon in the United States as the large 'boom generation' steadily approaches retirement age. .

On the other hand, the crowding-in syndrome should mean that the reduced cohorts which follow the fertility decline should find employment opportunities easier to obtain, and salaries relatively higher. The result of this is rising income expectations and aspirations for a better life all round. Insofar as these are realised there is an associated "birth spurt" as young people's confidence in starting families (or adding to them) grows and grows. This is the phenomenon we saw at work in Latvia - complete with the very high rates of wage inflation - in the years of boom - even if the heightened aspirations was more the product of a "pinching" of young labour supply through out migration than it was of lower fertility at that point, that impact is still to come basically. Now, however, we see the other side of the coin, as the sharp contraction produced by the rapid deflating of the earlier boom throws everything into reverse gear.

The argument here is not that demographic movements produce the boom bust, but that such processes serve to amplify the distortions, and this is what we can quite clearly see happening in Latvia I feel.

So far Maconovich and Easterlin, but Lutz and his colleagues offer a further, and most suggestive) direction for analysis: low fertiliy (via the population momentum impact) accelerates the process of societal ageing, and boosts the importance of the elderly dependency ratio. This in turn cuts growing pressure on health, welfare and pension benefits, generates a general pessimism about the future and lowers expectations about future income growth. Thus the earlier rising income expectations which were previously associated with those "narrow" cohorts, now become more difficult to sustain as the fiscal burden weighs down on younger generations, and this has the consequence that they continually postpone starting families.

The general pessimism that ensues, coupled with ongoing pension reforms which effectively reduce guaranteed benefits at a time when life expectancy is increasing, only serves to produce an increase in saving for the future, which, of course immediately represents a drag on current consumption. The drag on consumption leads to a far more lethargic level of economic growth, and this only adds to the negative cycle since it effectively induces young people to delay further having children in order to attempt to maintain current income. This type of economic chain reaction, especially plausible in the light of what we have actually seen happening in Germany and Japan (the two countries who have advanced furthest in this particular demographic transition), does seem to be one of the possible mechanisms through which Lutz's trap - should it in fact exist - might operate.

In fact Macunovich takes the Easterlin theory even further, and tries to use it to develop a general theory of the whole demographic transition as a process operating almost in its entirety via cohort effects. At this level I find her argument not entirely convincing. The cohort dimension is however very evident in the US baby-boom phenomenon, and the subsequent fertility reaction, and indeed this has had the consequence that population ageing is being seen very much as a cohort phenomenon in the United States, but this US experience is perhaps hard to generalise. What is evident though, is that the cohort phenomenon, and the changes in economic dynamic that it produces, does generate very real and important short run effects, and this is just where Lutz's idea becomes important, since if the population process is not a homeostatic (self regulating) one (which it isn't at this point) but rather a path-dependent one, where long run outcomes are highly sensitive to short run changes, then the short run impacts we are seeing operating now in a country like Latvia (and Hungary, and Ukraine) become potentially very important indeed, since - via another of Lutz's pathways (the population momentum one) they can in fact make the difference between long run sustainablility and unsustainability for a country, and I do wish that the EU Commission and the IMF would open up their ears, and listen to this argument, at least just a little bit. The evidence is mounting, the only thing which is not clear is for how long people are effectively able to ignore it. Not until it is too late to react, I hope.

The Relative Income Low Fertility Trap Mechanism At Work In Latvia?

Well, as I said ealier both the argument and the evidence on how a restricted cohort might lead to strong rising income expectations are clear enough, and now there is little doubt that Latvia is facing a very sharp economic contraction. This is leading to falling living standards, deteriorating employment stability expectations, growing pessimism, and of course (as we will see below) falling births.

Indeed only this weekend the Latvian Cabinet met in emergency session, in order to reach to agreement a the package of measures to be put before parliament. These measures - I think it is hard this part really is the unkindest "cut" of all - are actually being demanded by the leaders of the European Union (via their representatives on the European Commission) in order to agree the release of the next tranche of the Latvian "bail out" loan, and among measures being discussed are a reduction of 10% in both state pensions and maternity and child care benefit. The former may be hard, but unavoidable the latter, as we will see, more or less amounts to voluntarily agreeing to slit your own thoat.

Monthly Births The New "Lagged" Indicator For Latvia?

Let's take a look at the problem. Births have long been falling in Latvia. In the mid 1980s they hit a peak, at a little over 40,000 annually. Then, in harmony with what most economists and demographers would expect, fertility dropped sharply, and hit a historic low in the mid 1990s (under the impact of the transition shock) - with a peak to trough fall of something over 50%. As we can then see in the chart below, fertility rebounded in the late 1990s under the impact of rising living standards, and due to the fact that more or less record numbers of people entered the childbearing age group.

Unsurprisingly then, the Latvian period fertility measure (the total fertility rate) started to tick upwards again from the record low of 1.12 hit in 1998.

Unsurprisingly then, the Latvian period fertility measure (the total fertility rate) started to tick upwards again from the record low of 1.12 hit in 1998. But what has been happening to births since the crisis broke out? Well, fortunately the Latvian statistics office do publish monthly live birth stats, so this is one indicator we can track fairly easily. Here's the chart from the start of 2007, but there is so much volatility (seasonal variation?) that it is hard to see exactly what is going on.

But what has been happening to births since the crisis broke out? Well, fortunately the Latvian statistics office do publish monthly live birth stats, so this is one indicator we can track fairly easily. Here's the chart from the start of 2007, but there is so much volatility (seasonal variation?) that it is hard to see exactly what is going on. However, if we apply an old economist's trick, and look at the year on year variation, the pattern gets a bit easier to see.

However, if we apply an old economist's trick, and look at the year on year variation, the pattern gets a bit easier to see. And then if we apply another seasoned economist's "quick and dirty" procedure to iron out a bit of the seasonal variation by smoothing with a three month moving average chart, the picture seems very clear indeed. As output drops, and living standards fall, so to does Latvian society's "production of children".

And then if we apply another seasoned economist's "quick and dirty" procedure to iron out a bit of the seasonal variation by smoothing with a three month moving average chart, the picture seems very clear indeed. As output drops, and living standards fall, so to does Latvian society's "production of children". And of course, the negative population dynamic goes even further than this, since we have out-migration to think about. We have official monthly figures from the stats office, and even if these undoubtedly underestimate the size of the movement, the data quite possibly does give reasonable evidence of the trend, and what we can see in the chart below is not good news, since the rate of emigration is obviously rising.

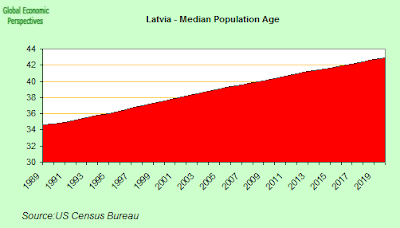

And of course, the negative population dynamic goes even further than this, since we have out-migration to think about. We have official monthly figures from the stats office, and even if these undoubtedly underestimate the size of the movement, the data quite possibly does give reasonable evidence of the trend, and what we can see in the chart below is not good news, since the rate of emigration is obviously rising. Now these two factors, migration and births have a direct impact on a third indicator - population median age, and as we can see this is rising in Latvia, and very rapidly, with pronounced and important implications for both elderly dependence and economic performance. And of course, the median age assumptions for future fertility between now and 2020 where made on the more postivive outlook of improving fertility which prevailed before the crisis.

Now these two factors, migration and births have a direct impact on a third indicator - population median age, and as we can see this is rising in Latvia, and very rapidly, with pronounced and important implications for both elderly dependence and economic performance. And of course, the median age assumptions for future fertility between now and 2020 where made on the more postivive outlook of improving fertility which prevailed before the crisis. Now, from our more general studies of the economic impacts of ageing population, it is apparent to Claus Vistesen and I that the medain age of forty is something of a watershed for any population. The entire structural characteristics of an economy begin to change from this point in the ageing process, and the economy becomes increasingly export dependent as we can see in the case of high median age societies like Japan, Germany and Sweden.

Now, from our more general studies of the economic impacts of ageing population, it is apparent to Claus Vistesen and I that the medain age of forty is something of a watershed for any population. The entire structural characteristics of an economy begin to change from this point in the ageing process, and the economy becomes increasingly export dependent as we can see in the case of high median age societies like Japan, Germany and Sweden.

But something is different in the Baltics, since male life expectancy is much lower than in the above mentioned countries, on average nearly 10 years lower, as can be seen from the comparison between Germany and Latvia to be seen in the chart below.

Now, from a strictly pragmatic point of view someone might be tempted to say, well "where's the problem there, less pensions to pay" (leaving aside the obvious humane issues), but this isn't the point, since the dependency ratios are set to rise sharply even assuming this mortality rate. The problem is that most of the remedies for offsetting the ageing population dependency issues assume the viability of raising labour force participation levels in the 55 to 65 age groups, and in the Latvian case many of the men involved - the ones whose infusion into the labour force is set to "dynamise" the economy - either simply aren't there, or are in very poor health.

Now, from a strictly pragmatic point of view someone might be tempted to say, well "where's the problem there, less pensions to pay" (leaving aside the obvious humane issues), but this isn't the point, since the dependency ratios are set to rise sharply even assuming this mortality rate. The problem is that most of the remedies for offsetting the ageing population dependency issues assume the viability of raising labour force participation levels in the 55 to 65 age groups, and in the Latvian case many of the men involved - the ones whose infusion into the labour force is set to "dynamise" the economy - either simply aren't there, or are in very poor health.So no, this is not simply one more plea for leaders of Latvia to get to work and devalue the currency. It is a plea to those leaders to stop and think a little about the implications of what they are doing. Surely no one can be happy to see their country flushed down the tubes in quite this way?

And for purposes of comparison, here is the chart for Hungary. Actually this one really is fascinating for those of you who know anything about what has been happening in Hungary. In June 2006 there was a major financial crisis in Hungary. And guess what? You can see this in the births nine months later. Then births recover again, and then, of course, they start to deteriorate. Now the crisis hit Hungary sharply in October 2008, so if this theory is at all right, we should see another sharp deterioration in Hungarian births around August/September 2009.

References

Bloom, D., R. Freeman and S. Korenman. 1987. “The Labor Market Consequences of Generational Crowding”, European Journal of Population, 1987, 131–176.

Easterlin RA (1975). “An Economic Framework for Fertility Analysis” Studies in Family Planning, 6(3):54-63.

Easterlin RA (1978). "What Will 1984 be Like? Socioeconomic Implications of Recent Twists in Age Structure," Demography, 15(4):397-432 (November).

Easterlin RA (1980). Birth and Fortune: The Impact of Numbers on Personal Welfare, Basic Books: New York.

Easterlin RA (1987). “Easterlin Hypothesis”, pp.1-4 in J Eatwell, M Milgate, P Newman (eds) The New Palgrave: A Dictionary of Economics 2, Stockton Press: New York.

Korenman S and Neumark D (1997). Cohort Crowding and Youth Labor Markets: a cross-national analysis”, NBER #6031,

Cambridge, MA.

Lutz, Wolfgang, Maria Rita Testa, Vegard Skirbekk, 2006. The "Low Fertility Trap" Hypothesis, Paper presented at the Population Association of America (PAA) 2006 Annual Meeting, March 30 - April 1, Los Angeles, California

Lutz, Wolfgang, Maria Rita Testa, Vegard Skirbekk, 2005. The "Low Fertility Trap" Hypothesis power point presentation at the Postponement of Childbearing in Europe conference held at the Vienna Institute of Demography, 1-3 December 2005, Vienna, Austria

Macunovich, D.J. 2002, Birth Quake: The Baby Boom and Its Aftershocks. Chicago: University of Chicago Press

Macunovich, D.J. 2000, Relative Cohort Size: Source of a Unifying Theory of Global Fertility Transition? Population and Development Review, Volume 26 Issue 2, June 2000

Macunovich, D.J. 1998a, Relative Cohort Size and Inequality in the U.S. American Economic Review (Papers and Proceedings) May 1998 88(2):259-264

Macunovich, D. J. (1998) “Fertility and the Easterlin hypothesis: An assessment of the literature.” Journal of Population Economics 11:53-111.

11 comments:

Quite interesting correlations you point out. However having children is not always a question of economic security but other factors influence the decision to bear child.

However I see the migration from Latvia as a much bigger problem for the country as a whole.

I can just speak from my personal experiences but in my wifes family there are 3 of 10 relatives and friends are already working abroad and I think only 1 of 10 is official in the Latvian statistics.

And it is the young women that are away not the men nor elderly except for my mother in law ;-)

BLA, BLA, BLA:

08.06.-12.06.2009 Selling lats, the Bank of Latvia bought 160.0 million euro

Gottcha:P

Robert is quite right. I would say that Latvia will fairly soon have i) very high unemployment rate (30% would be my guess), ii) relatively low wages, and iii) quite skilled and educated workforce.

What will surely happen, if skilled people can not find jobs, and those few jobs available will pay minuscule wages, and the social security net will not support them and their families? Those people will take the first flight to elsewhere.

It has happened in the CEE countries so many times since the fall of communism: there has been massive outward migration from Poland during the 1990s, a very significant outward migration from the Czech Republic during the same time, and there continues to be a steady stream of migrants from both the Ukraine and Slovakia, of which Prague has been a notable recipient.

Considering that incentives to emigration in either Poland or Slovakia have never been so strong as they may soon be in Latvia, yet still Poles and Slovaks have been leaving, we should not be surprised if relatively large numbers of Latvians start seeking work wherever it can be found.

Of course, the outward migration may be temporary at first, but if teh conditions in Latvia do not change very quickly, temporary may become permanent rather easily.

To: Hynek Filip

Yes you are quite right that temporary fast become permanet especially after the first child abroad.

I just need to look at my wife and her friends here in France to see that they are not going back to Latvia.

Bad for Latvia but good for the individuals that have left. People make decision in favor to them self (and family) and not for the common good.

There is still an incentive in Latvia : the "mother's pay". Every woman here can get a big share of her last income during the child's first year, allowing her to stay home during that time. Alas, this social measure has been under constant attack from the government during the last weeks.

These threats of reducing the allowance have lots of couples postponing their decision. Especially as other family social support just was diminished.

Other European (and non European) countries provide a much better support and with a lower tax pressure on individuals. Most mixed couples (mine among others) start seriously thinking about emigration. But when you have invested most of your capital in Latvia, there is no point in going now : no way to sell your assets at a decent value. This also goes for the Latvians who would like to emigrate but still have assets in Latvia.

Therefore, though there is a huge increase of enquiries for emigration in all embassies after each new governmental decision to cut budgets, there might be also a wave outwards when the market (especially real estate) "restarts".

The move that was started by the Latvian crisis will have quite long terms echoes in the demographics.

To Philippe

I see your point and you are probably correct in your assumption, unfortunate for you I think it will be a long time before things start to pick up on investment made in Latvia.

to Robert

Not necessarily so: Latvia's economy since 1991 independance works on the boom-bust-boom-bust cycle. Every time, when Latvian assets go to their lowest value, they become interesting for foreign investors. Granted, the current situation, by its globality, reduces the number of possible foreign investors.

But as other countries will bounce back up faster than Latvia, the difference between available liquidities to invest and Latvian low prices will make it again a desirable market.

Let's not forget that not all of the credit frenzy went in thin air or as a pocket liner for Latvian ministers' friends. Lots of it was used to modernize or create viable production infrastructure. These factories, workshops, farms, etc... can already be bought for a very fair (for the buyer) price. The current "budget diet" already is driving down the price of the Latvian workforce. One or two notches down, a stabilization of the economies of a few neighbours (ok, this time Russians are out of the picture. Is it so bad ?), and we won't have to wait so long to see again the nose of Germans, Scandinavians and others to come and sniff good opportunities.

Two years, three top. Patience and good survival skills are needed, sure. But not in vain.

I tried to translate your article into a set of interrelated feedback loops.

.

If you understand Portuguese... after all not very different from Castillian, you can see then:

.

http://balancedscorecard.blogspot.com/2009/06/abencoada-internet-parte-iii.html

"I tried to translate your article into a set of interrelated feedback loops."

Fantastic, thanks a million.

Post a Comment