“It’s 20 years after Europe was united in 1989 – what a tragedy if you allow Europe to split again.”

Robert Zoellick, World Bank president, in an interview with the Financial Times

(Click On Image To View Video)

(Click On Image To View Video)

World Bank president, Robert Zoellick, made a call this week - in an interview with the Financial Times - for a European Union-led and co-ordinated global support programme for the economies of Central and Eastern Europe. I agree wholeheartedly, and even if I have, reluctantly, to accept the point made last week by our Economy & Finance Commissioner Joaquin Almunia that our pockets, though deep, are certainly not bottomless (and thus it is probably beyond our means right now to rescue the non-EU Eastern states), I still feel we should make good on our responsibilities to those who are EU members, and to do so by opening the doors of the Eurozone to those who wish to join. Since this proposal is fairly radical, the justification that follows will be lengthy.

This is not a view I have arrived at lightly, but looking at the extent of the problem we now have before us, a problem which is growing by the day, and taking into account the fact that the origins of the economic crisis in the East must surely rest (at least in part) in the decision to make euro participation a condition for EU membership for these countries (a possibility which was subsequently withdrawn in the critical moment, when the going started to turn rough), and then assessing the risk to the Western European banking system which would be posed by simply sitting back and watching it all happen, I think this move is not only the least damaging of the policies we can now follow, it is the in effect the only viable path left to us if we are to keep the eurozone as an integral entity together.

If this proposal were accepted a new set of membership criteria would need to be drawn up, of course, but the underlying principle would have to be one of offering the certainty of entry as guaranteed forthwith, for those who chose to accept. Rules were made to be broken, and nothing should be so inflexible - not even the Maastricht eurozone membership criteria - that it cannot be ammended as circumstances dictate. And at this point even the undertaking that this - like the long awaited US Stimulus programme - was on the table, would be sufficient to provide immediate, and much needed relief. Flirting with doing nothing here is, in my opinion, flirting with disaster, both in the East and in the West.

Existing Maastricht Criteria

Convergence criteria (also known as the Maastricht criteria) are the criteria for European Union member states to enter the third stage of European Economic and Monetary Union (EMU) and adopt the euro. The four main criteria are based on Article 121(1) of the European Community Treaty. Those member countries who are to adopt the euro need to meet certain criteria.

1. Inflation rate: No more than 1.5 percentage points higher than the three lowest inflation member states of the EU.

2. Government finance:

Annual government deficit: The ratio of the annual government deficit to gross domestic product (GDP) must not exceed 3% at the end of the preceding fiscal year. If not, it is at least required to reach a level close to 3%. Only exceptional and temporary excesses would be granted for exceptional cases.

Government debt: The ratio of gross government debt to GDP must not exceed 60% at the end of the preceding fiscal year. Even if the target cannot be achieved due to the specific conditions, the ratio must have sufficiently diminished and must be approaching the reference value at a satisfactory pace.

3. Exchange rate: Applicant countries should have joined the exchange-rate mechanism (ERM II) under the European Monetary System (EMS) for 2 consecutive years and should not have devaluated its currency during the period.

4. Long-term interest rates: The nominal long-term interest rate must not be more than two percentage points higher than in the three lowest inflation member states.

The Dimensions Of The Problem

European governments, the European Union and international financial organizations need to act fast on risks stemming form banks’ exposure in the eastern part of the continent to avert an escalation of the credit crisis, Nomura Holdings Inc. said. East European countries are struggling to refinance foreign- currency loans taken out by borrowers during years of prosperity through 2007, when economic growth averaged at more than 5 percent. The International Monetary Fund, which has bailed out Latvia, Hungary, Serbia, Ukraine and Belarus, warned on Jan. 28 that bank losses may widen as “shocks are transmitted between mature and emerging market banking systems.” “Swift action is needed to restore confidence and prevent trouble” to financial and economic stability in the euro region and emerging Europe, said Peter Attard Montalto, an emerging markets economist at Nomura International in London. “Any move should be quick. The situation has begun to decline more rapidly since the end of last year and there is risk that any action may come too late.”

Bloomberg

Robert Zoellick is far from being a lone voice in the wilderness about the current level of risk to the coutries in the East, and indeed precisely those EU banks who have been most active in emerging Europe are now busily trying to convince EU regulators, the European Central Bank and Brussels itself to coordinate new measures to counter the impact of the financial crisis confronting the region. The problem in the East certainly now adds a new dimesion to the problems facing us here in Europe, since West European governments are now being simultaneously hit on a number of fronts, and the situation is become more complicated by the day.

In the first place most West European economies are now either in or near recession, and their domestic banking systems are, to either a greater or a lesser extent, struggling. The West European states are thus, by and large, already feeling stress on their own sovereign borrowing capacities. But, with greater or lesser effectiveness, these countries are still able to increase their debt, even if sometimes the surge in borrowing is very dramatic, as in the case of Ireland, which will see gross debt/GDP shooting up from 24.8% in 2007 to a projected 68.2% in 2010 (EU January 2009 Forecast).

The situation in Eastern Europe is very different, and their economies and credit ratings evidently can't support such dramatic increases in their debt levels. Thus, in the case of those countries with a significant home banking presence, like Latvia's Parex, or Hungary's OTP, the support of external organisations (the IMF, the World Bank, the EU) becomes rapidly necessary when the bank concerned starts to have liquidity problems. But as a result of the consequent bailout the debt to GDP ratio starts to rise in a way which then places even subsequent eurozone membership in jeopardy. Latvia's Debt/GDP is, for example set to rise from around 12% of GDP in 2007 to over 55% in 2010. With a 10% plus GDP contraction already in the works for 2009, it is clear that Latvia's debt to GDP will rise beyond the critical 60% level. Hungary's debt/GDP is already above, and rising. If we don't do something soon, these two countries at least are being launched off towards sovereign default.

But the other half of this particular and peculiar coin turns up again in a rather unexpected way, and that is in the form of those West European banks who have subsidiaries in CEE countries, and who find now themselves faced, not with bailouts, but with ever rising default rates. This difficulty evidently and inevitably then works its way back upstream to the parent bank, and to the home state national debt, as the bank almost inevitably needs to seek support from one West European government, or another (in fact Unicredit, which has difficulty getting money from an already cash-strapped Italian government is talking of applying for support from the Austrian government via its Austrian subsidiary).

Austria is, in fact, a very good case in point here, since, as Finance Minister Josef Proell recently indicated, the country had some 230 billion euros of debt outstanding in Eastern Europe, equivalent to around 70 percent of Austria's GDP. The Austrian daily "Der Standard" have also reported the analysts view that a failure rate of 10 percent in Eastern Europe's debt repayments could lead to serious difficulties for Austria's financial sector. And this is no hypothetical "what if" type problem since the European Bank for Reconstruction and Development (EBRD) has estimated Eastern Europe's bad debts could go over 10 percent and could even reach 20 percent in the course of the current crisis. Underlining the mounting concern in Austria, Proell tried last week to convince EU finance ministers to provide 150 billion euros is support to CEE economies as a first step in trying to contain the growing wave of defaults.

The total quantity of debt outstanding is hard to put a precise number on, but the Bank for International Settlements estimated that, as of last September, more than $1.25 trillion had been leant by eurozone banks, and if you add in U.K., Swedish and Swiss bank liabilities the number rises to $1.45 trillion.

Western Europeean banks have a very important market share in the East, ranging from a low of 65 percent in Poland to almost 100 percent in the Czech Republic. This basically means two things, that the region's businesses and consumers are extraordinarily dependent on uninterrupted capital inflows from the West, and that some West European banking systems are extremely sensitive to rising default rates in the East. Of course the problem goes beyond the EU's borders, and while EU bank market shares in the Community of Independent States is rather less significant than in the EU12, due to the still substantial domestic ownership which exists there, exposure to defaults is not unimportant, especially in Ukraine, Kazakhstan and, of course, in Russia itself. Further, there is South East Europe to think about, and countries like Serbia and Croatia.

Large Banks Take The Initiative

Getting near to desperation, some of the largest banks involved - Italy's UniCredit and Banca Intesa, Austria's Raiffeisen International and Erste Group Bank, France's Societe Generale and Belgium's KBC - have launched a common initiative to try to lobby for an EU wide solution to the problem.

UniCredit is the largest lender in Poland and Bulgaria, while Erste is number one in Romania, Slovakia and the Czech Republic, with KBC occupying the position in Hungary, Intesa in Serbia, and Raiffeisen in Russia and Ukraine. Hungary's OTP Bank, emerging Europe's number 5 lender and the largest one in its home country, does not formally belong to the group. On the other hand OTP is actively looking for support.

OTP Bank Nyrt., Hungary’s biggest bank, said it’s in talks over a “role” for the European Bank for Reconstruction and Development, as it announced a 97 percent drop in fourth-quarter profit and “substantial” job cuts. As well as a possible EBRD involvement, OTP may also seek funds from Hungary’s emergency loan package from the International Monetary Fund, the European Union and the World Bank to “better serve the economy,” Chairman and Chief Executive Officer Sandor Csanyi said at a press conference in Budapest today. “There’s a chance the EBRD will assume a role in OTP, but I must stress that we plan no issue of new shares,” he said. OTP “doesn’t need to be saved,” Csanyi added.

Chancellor Angela Merkel, while expressing support for the bank initiative, has stopped short of offering concrete assistance or suggesting measures beyond those which are already in place.

The president of the European Bank for Reconstruction and Development, Thomas Mirow, wrote in the Financial Times this week the bank proposals "deserve full support as a worsening crisis in emerging Europe will threaten Europe as a whole".

The Austrian government has already announced it is trying to raise support for a general European Union initiative to rescue the region’s banking system. The government has set aside 100 billion euros in cash and guarantees to stabilise its banking sector. Next in line in terms of exposure are Italy ($232 billion), Germany ($230 billion) and France ($175 billion).

Unicredit is publicly rather dismissive of the problem (as can be seen from the slide below which from a presentation they gave earlier this week, please click on image to see better), but Italian investors are far from convinced by their arguments, as witnessed by the fact that their stock has plunged 41 percent this year, and by the fact that they were forced to sell 2.98 billion euros in 50 year bonds this week to shore up their Tier I capital after investors only bought about 4.6 million shares, or 0.48 percent, from their most recent rights offer. UniCredit, which said last month it is considering asking for government assistance, has also been disposing of assets to raise money and it plans to pay shareholders their dividends in yet more shares. Nationalisation of banks to supply credit lines to the private sector is one hypothesis currently being studied by Silvio Berlusconi, according to a Financial Times report this morning.

(Click on image for better viewing)

(Click on image for better viewing)

The Austrian proposal includes funds from the European Investment Bank, the European Central Bank and the EU Cohesion Fund. The Austrian government has offered money of its own and has been urging Germany, France, Italy and Belgium as well as the EU itself to contribute. One feature, however, stands out in all of the proposals which have so far been advanced: they are loan based-support. What Soros calls the "tricky question" of fiscal allocation from Europe's richer member states has not so far been raised, but it will be, since it will have to be.

And of course, Austria's concern is far from being altruistic, as Austria's economy and sovereign debt stability depend on finding a solution. It is hardly surprising to learn that credit-default swaps linked to Austrian government debt soared this week - by 39 basis points to a record 225 - on concern the country will need to bail out the domestic banks itself as they report losses and writedowns linked to eastern European investments. Erste, which said last week that full-year profit probably slumped by almost 26 percent, is in talks with the government to get 2.7 billion euros ($3.4 billion) in state aid. RZB has asked for 1.75 billion euros.

The European Central Bank on the other hand, seems reluctant to extend emergency financial help to crisis-hit countries beyond the 16-country eurozone. The ECB did not have “a mandate to be a regional United Nations agency”, Yves Mersch, governor of Luxembourg’s central bank, recently told the Financial Times. Such comments reveal the level of resistance which exists within the ECB’s 22-strong governing council to the idea of offering financial support to countries outside the zone.

The ECB has so far offered loans to Hungary and Poland, but has attached what some consider to be excessively strong conditions on facilities allowing them to borrow up to 5billion and 10billion euros respectively. Mr Mersch, whose views are thought to be widely shared in the ECB, suggested the central bank was worried about setting precedents if it relaxed its stance on helping individual countries. While some euromembers might favour assisting nearby nations, “we must not forget that other people might be sensitive to different countries”.

Who Bails Out The West European Banks In The East?

Governments and EU officials are struggling to formulate a coherent response to the economic and financial turmoil that has started to engulf the eastern part of the old continent. EurActiv presents a round-up of national situations with contributions from its network. Leaders of EU countries from central and eastern Europe will meet on 1 March ahead of an extraordinary summit on the same day with the bloc's other members, it emerged on Thursday (19 January). Polish Prime Minister Donald Tusk has invited his counterparts from the Czech Republic, Slovakia, Slovenia, Romania, Bulgaria, Lithuania, Latvia and Estonia for the talks to ensure the 27-nation meeting on the financial crisis is not dominated by the interests of Western member states. See full Euractiv article on background.

The EU has so far provided emergency balance-of-payments assistance to two of the East European member states in difficulty - Hungary and Latvia, and EU ministers did agree in December to more than double the funding available for such emergency lending to 25 billion euros ( so far Hungary has been allocated 6.5 billion and Latvia 3.1 billion). It is also quite probable that such lending will now have to be extended to the two newest southeast European members, Romania and Bulgaria, since their ballooning current account deficits and dramatic credit crunches mean that they are steadily getting into more and more difficulty.

The core of the problem is that the East European economies enjoyed strong credit driven booms, which fuelled higher than desireable inflation and lead to strong foreign exchange loan borrowing which simply bloated current account deficits. Now capital flows into emerging Europe have dried up as the global financial crisis has raised investors' risk aversion and prompted them to dump emerging market assets, leaving foreign-owned banks as the only source of loans for companies and consumers.

Italy's UniCredit, the biggest lender in emerging Europe, warned at the end of January that there was a clear risk of the global credit crunch gripping the region. UniCredit board member Erich Hampel stated at a Euromoney conference in Vienna that the bank was committed to fund its subsidiaries in the CEE countries and would continue to lend, but at the same time made absolutely clear that in order to do this his bank would need government support, whether from Austria, or Poland, or Italy itself.

Hampel said Bank Austria would decide during the first quarter whether to tap the Austrian government's banking stability package for fresh equity. " he said. "Our budget is under discussion now and clearly assumes growth in lending and in funding to the East. "

And according to a report from the Austrian central bank the fact that a relatively small number of Western European groups - including three Austrian ones - own most of the banks in Central and Eastern Europe means that there is the risk of a "domino effect", implying the crisis would spread quickly from one country to another. "How capital flows into (emerging Europe) will develop depends on the financial strength of the parent groups and of the sister banks, and on whether the parents are willing and able to fund their subsidiaries," the bank's half-yearly Financial Stability Report said. "The risks to refinancing are increased by the danger of a domino effect, because a large part of the foreign capital in many countries comes from a relatively small number of Western European banks," .

"What we see is that the emerging European economies have lost all sources of funding but banking," said Deborah Revoltella, chief economist for central and eastern Europe of UniCredit, the region's biggest lender. The task to carry whole economies through a downturn comes at a time when parent banks already face a double challenge: a likely sharp rise in loan defaults at their eastern subsidiaries and more difficult and expensive refinancing for themselves. "The international banks cannot solve this situation," Revoltella said. "They can do their part, and it's fundamental that they do their part but we have to take care of the other sources of funding which are missing now."

And it isn't only Austria who is worried, since Greek central bank governor George Provopoulos warned Greek banks only last Tuesday against transferring funds from the country's bank package to the Balkans, where they have invested heavily.

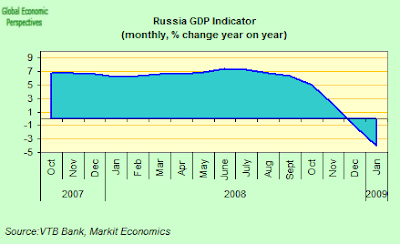

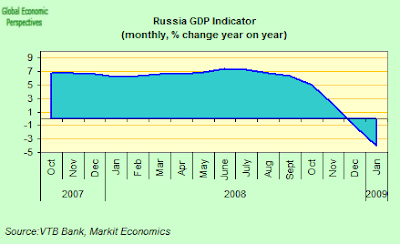

Regional RisksIn our view GDP growth is like to be negative in all CEE countries this year. In those countries “least” affected by the crisis (i.e. Poland, the Czech Republic, Slovakia and Slovenia) GDP is like to drop at least 2-5%, while those countries worst affected (i.e. the Baltic States, Bulgaria, Romania and Ukraine) are likely to face double digit declines in GDP. In other words, in terms of expected output lost in the region this is as bad as or even worse than the Asian crisis of 1997-98.

Danskebank - CEE: This Looks Like Meltdown

The problem that the EU has in adressing the situation in the Eastern member states is that what we have on our hands is not only a banking crisis, there is also a strong credit crunch at work, one which is now having a severe impact on the real economies in the region. Most of the economies in the region are already in recession, and those that are not soon will be (I have intersperced a number of relevant graphs throughout this post which should give some general impression of what is happening). Thus these countries are all taking multiple hits at one and the same time.

1/ In the first place they have an economic contraction on their hands, in some cases becuase they are struggling with a steep decline of export demand from western Europe, in others because their externally financed credit boom has now come to a sharp and painful end.

2/. Most countries in the region have some form of foreign currency exposure, although at present this is largely household and corporate rather than sovereign. In a number of countries -notably Hungary, Romania, Bulgaria and the Baltics this is particularly onerous since most of the mortgages were taken out in euros or Swiss Francs, and the default risk is now rising as their economies either deflate (internal devaluation) or their currencies fall as part of the regional sell-off. The danger is that as the bailouts are implemented at local level this exposure is steadily transferred over to the sovereign level, creating a dangerous dynamic which can endanger future eurozone membership. States which default will be unlikely candidate members.

3/. These countries are also suffering the impact of significant asset writedowns, as those assets bought at very high prices during the boom - some at up to six times their book value - now have to be written down, further weighing on earnings and weakening financial and corporate balance sheets.

4/ Finally there is significant contagion risk. The comparatively small number of foreign lenders involved has lead IMF economists and the credit ratings agencies alike to repeatedly warn of how the risk that a seemingly isolated incident in one country may rapidly spread right across the region.

"I don't think it's an exaggeration to say that the whole banking sector and financial system (in the region) rests on the response of parent banks," said Neil Shearing, economist at Capital Economics. "If they withdraw funding it's not very difficult to see how there would be a very severe financial crisis sweeping across the region, and the whole region en masse would have to go to the IMF," he said.

Governments in the region have already taken what measures they can. Most increased deposit guarantees from 20,000 to 50,000 euros following the EU October Paris meeting. Lithuania went further and upped the limit to 100,000 euros, while Slovakia, Slovenia and Hungary all now offer unlimited protection. But this begs the question, who guarantees the government guarantees in the event they are called on.

So the problem has now become a very delicate one, since the banks want to maintain their presence in the region even while almost every factor imaginable is working against them. The latest such factor is the threat of credit downgrades for their core business in Western Europe, and Moody’s Investors Service warned only this week that some of Europe’s largest banks may be downgraded because of loans to eastern Europe, a warning which sent Italy's UniCredit to its lowest level in the Milan stock market in 12 years.

Moody’s argues there will be “continuous downward rating pressure” in the region as a result of worsening asset quality and western banks’ reliance on short-term funding. UniCredit’s Bank Austria subsidiary earned almost half its pretax profit from eastern Europe in 2007, Raiffeisen International Bank-Holding almost 80 percent and Austria’s Erste Group Bank more than 60 percent, according to Moody’s.

“The most risky parts of the western European banks’ businesses are in eastern Europe and when you decide to cut risks, you cut back on the most risky assets first,” Lars Christensen, an analyst at Danske Bank A/S in Copenhagen, said by telephone today. “This could add further risk in the region as the economies there may face large current account deficits if funding from western European banks is withdrawn.”

As a result last Tuesday we saw a surge in the cost of protecting bank bonds from default, lead by Raiffeisen International Bank-Holding and UniCredit. Credit-default swaps on Vienna-based Raiffeisen climbed 26 basis points to a record 369 and those for UniCredit soared 23 basis points to an all-time high of 213, according to data from CMA Datavision in London. Credit-default swaps on Erste increased 24.5 to 307, Paris- based Societe Generale rose 6 to 116 and KBC in Brussels was unchanged at 240, according to CMA prices.

The rising cost of insuring against default by a “peripheral” European government is likely to weigh on the euro, according to Merrill Lynch & Co. “This remains an important background negative for the euro,” Steven Pearson, a strategist in London at Merrill Lynch, wrote in a note today. “European banking-sector exposure to Eastern Europe, often via foreign currency lending, is an additional euro negative story that is gaining air-time.” Emerging market central banks may move away from holding European government bonds in their reserves as widening yield spreads between debt of different euro-zone economies makes bonds more difficult to trade, Pearson said.

So Why Would The Euro Help?

So Why Would The Euro Help?Well, in the first place, four of the Eastern economies - Bulgaria, Latvia, Lithuania and Estonia, are effectively stuck, since their currencies are pegged to the Euro. They are in the unenviable position of being stuck between the proverbial rock and the hard place. They are now faced with US depression type economic slumps, and massive internal wage and price deflation all at the same time. Would Euro membership help? Well lets look at what the IMF said in their most recent report on the stand-by loan arrangement for Latvia.

Accelerated adoption of the euro at a depreciated exchange rate would deliver most of the benefits of widening the bands, but with fewer drawbacks. Unlike all other options for changing the exchange rate, the new (euro-entry) parity would not be subject to speculation.

By providing a stable nominal anchor and removing currency risk, euroization would boost confidence and be associated with less of an output decline than other options.Euroization with EU and ECB concurrence would also help address liquidity strains in the banking system. If Latvian banks could access ECB facilities, then those that are both solvent and hold adequate collateral could access sufficient liquidity. The increase in confidence should dampen concerns of resident depositors and also help stem non resident deposit outflows.

However, this policy option would not address solvency concerns and has been ruled out by the European authorities. If combined with a large upfront devaluation, there would be an immediate deterioration in private-sector solvency, which could slow recovery. Privatesector debt restructuring would likely be necessary. Finally, the European Union strongly objects to accelerated euro adoption, as this would be inconsistent with treaty obligations of member governments, so this option is infeasible.

Basically, devaluating the Lat and entering the euro directly was the IMF's preferred option for Latvia, "euroization with EU and ECB concurrence" was the second option, and keeping the peg and implementing massive internal deflation only the third. The problem was that the EU, in its wisdom felt euro adoption "would be inconsistent with treaty obligations of member governments" - as would I suppose bailing out Austria and Ireland be "inconsistent with treaty obligations of member governments under the Maastricht Treaty. Go tell it to the marines, is what I say!

And this is not just Latvia, but four entire countries (little ones, but still countries) that are effectively being thrown to the wolves here.

Downward Pressure On Currencies, Upward Pressure On Interest RatesNor is the position of those with floating currencies - Poland, Hungary, the Czech Republic and Romania - much better, since their currencies are now coming under substantial pressure, and as a result defaults are growing, defaults which will only work their way back upstream to the Western Countries whose banks will have to stand the losses.

At the same time, the risk of a sharper, 1997 Asian-style adjustment cannot be excluded, given the similarities between Asia before the eruption of the crisis there in 1997 and the situation in emerging Europe. Beyond any considerations about valuation, the FX market may overreact as it did during the Asian or Russian crises in 1997 & 1998. To halt the downward spiral of currency depreciation, a substantial rise in interest rates combined with a tight fiscal policy under an IMF programme could be necessary.

Murat Toprak & Gaelle Blanchard, Societe Generale

Obviously there is now a sense of urgency here, and the warning signs are everywhere, for those who know how to read them. According to Zbigniew Chlebowski, the chairman for the Polish ruling party’s parliamentary group speaking in an interview earlier this week, the Polish government has been in official talks with the European Central Bank over joining the pre-euro exchange-rate mechanism “for several days.” So consultations are getting to be fast and furious.

And Hungarian, Polish and Czech government debt, which has been among the highest rated in emerging markets, is now being downgraded by bondholders. Investors are currently demanding 20 basis points more yield to own Hungary’s bonds than similar-maturity Brazilian debt, which is rated four levels lower by Moody’s Investors Service, according JPMorgan bond indexes. The risk of Poland defaulting is currently running at about the same as Serbia, ranked six levels lower by Standard & Poor’s, based on credit-default swap prices, while Czech 10-year bonds yield the most compared with German bunds since 2001.

“Everybody is running for the door,” said Lars Christensen, head of emerging-market strategy at Danske Bank A/S in Copenhagen. “The markets have decided the central and eastern European region is the subprime area of Europe.”

The currencies of these currenciies are tumbling on investor concern the region’s economies are among the most vulnerable to the global credit crisis. Poland’s zloty has fallen 35 percent against the euro since August, the forint - which has fallen around 13% since the start of the year, and about 25% since last August -weakened to a record low of 309.71 this week. At the same time the Koruna hit the lowest level since 2005.

(Chart above - Polish Zloty vs Euro)

The zloty has risen - against the previous trend - by 3.2 percent this week, following a decision by the Finance Ministry to enter the market (on Wednesday) and started selling euros from European Union funds for zlotys. Prime Minister Donald Tusk said yesterday the currency must be defended “at any cost.” The Czech central bank stated it regards the buying and selling currencies to manage the koruna as an “exceptional” tool that it’s resisted using since 2002, with the implication that it may not be able to resist much longer, although interest rate hikes (as practised in Hungary) seem to be the more likely approach in the Czech Republic. Such gains as have been obtained for the zloty are likely to be short lived (intervention is a tool of desperation, not of strength, and rarely has any lasting effect) and they can hardly exhaust EU funding they badly need to spend on stimulus type projects in the face of the downturn defending the indefensible, as Russia has been learning to its cost in another context.

“It [currency intervention ]is for us an exceptional tool at our disposal,” Tomas Holub, head of its monetary policy department, said in a telephone interview today. “Of course it’s one of the potential tools, but so far no decision has been taken in this direction.”

After intervention the only real tool left is interest rate policy, and fear of further currency falls is now acting as a serious brake on monetary policy as the pace of economic contraction gathers speed in one country after another. “A lowering of interest rates at the current levels of the exchange rate is completely out of the debate,” Deputy Governor Miroslav Singer told E15 newspaper earlier this week. “The question is whether to raise, and by how much.”

Really the suggestion that all these countries simply traipse off to the IMF (one after the other) in search of help is shameful. There is simply no other word for it, shameful. As Oscar Wilde put it, losing one child may be an accident, but losing all your children, now that has to be negligence! Let them in, and let them in now, before the whole house of cards collapses on top of each and every one of us.

PostcriptThis article is the second in a series of five I am in the process of writing on ways forward with Europe's financial and economic crisis.

The first was

Why We Need EU Bonds.

Subsequent articles will deal with:

a) The need for Quantitative Easing In The Eurozone

b) What might a new Stability and Growth Pact look like?

c) Why as well as rewriting the banking regulations we also need to do something about Europe's demographic imbalances.

Update: The Danskebank ViewWith

which I wholeheartedly agree.

This week the crisis in the CEE markets has intensified dramatically after the publication of a number of reports putting a negative focus on Western European banks’ exposure to the overly leveraged CEE economies. The crisis is clearly developing in an explosive fashion and there is a very clear risk of an Asian crisis style meltdown. The economies in the region are already in free fall, and at least one country – Ukraine – is dangerously close to sovereign default. Rapidly rising concerns have led policy makers across Europe to call for immediate action to avoid a dangerous collapse that potentially could spill into the euro zone. However, policy makers seem very divided on what to do in the current situation.

Earlier this week Lithuanian Prime Minister Andrius Kubilius called for coordinated action from the EU to try to solve the problems in CEE. Later in the week the World Bank’s president Robert Zoellick echoed Kubilius’ cry for help.

However, the EU Commission does not seem very excited about a coordinated effort to avoid meltdown. Rather Joaquín Almunia, EU monetary affairs commissioner, this week said that he would prefer a country-by-country approach to crisis management. In our view, a country-by-country approach to crisis management entails a number of risks, as there is a strong potential for contagion from one CEE country to another due to the significant integration in the financial sector across the region. Therefore, we think that there is urgent need for a more coordinated effort to stabilise the situation– otherwise this crisis will drag out and uncertainty remain elevated for an extended period.